FAQ: Illinois Journalism Payroll Tax Credit

A practical overview and answers to common questions about Illinois’ Local Journalism Sustainability Tax Incentive Program, including eligibility requirements, payroll tax credit amounts and the application process

FAQ | Application Guidance | Application Examples

Frequently Asked Questions

What is the Local Journalism Sustainability Tax Incentive Program? (Read carefully: Some Illinois local news outlets did not receive funds in 2025 because they wrongly assumed they were ineligible and did not apply.)

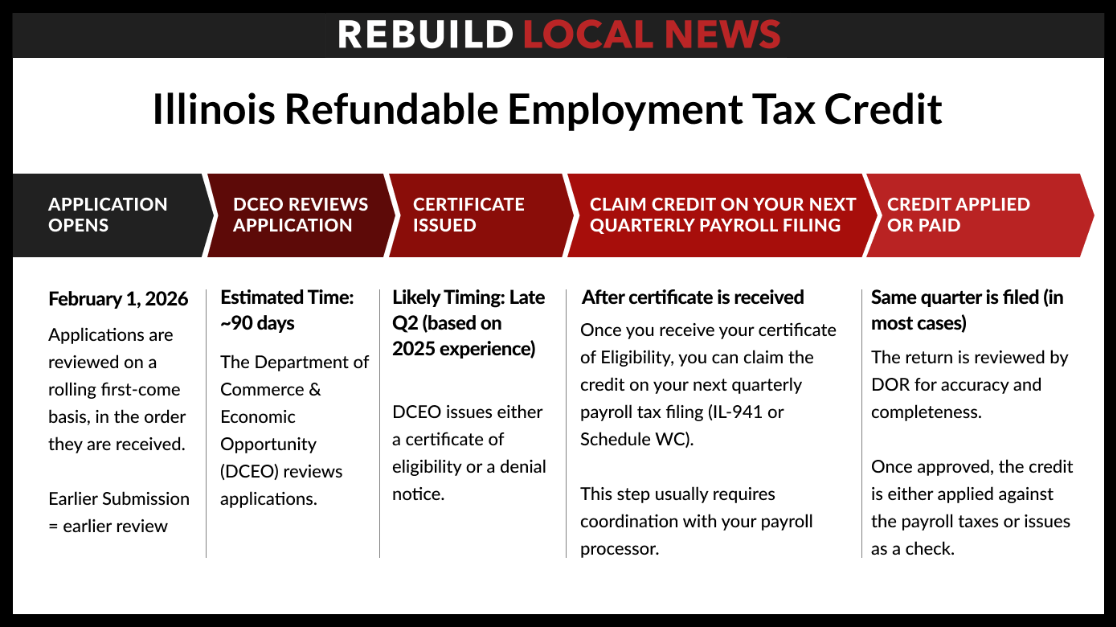

The Local Journalism Sustainability Tax Incentive Program offers refundable state tax credits designed to help local news entities retain and hire journalists by offsetting payroll costs. (“Refundable” means you could receive part of the sum in cash, like a grant.) You can start the application online through the DCEO portal. The application window will open on February 1, 2026. Tax credits will be awarded on a first-come, first-served basis, and there’s only a limited amount of credits available, so your chances of receiving funding for 2026 are much higher if you apply promptly.

Who is eligible?

You are likely eligible if your organization:

- Is a news outlet (either for-profit OR nonprofit)

- Produces original local journalism serving Illinois communities

- Employs full-time journalists or newsroom staff in Illinois (or is a sole proprietorship in which you are paid as a W-2 staffer)

- Is not primarily an aggregator, public relations outlet, or advocacy organization

- Is not a university-based public broadcast outlet

How much are the credits?

Eligible news entities may receive (up to a certain cap, described below):

- $15,000 in refundable tax credits for each qualified journalist employed during the prior 12 months. We will refer to this as the “retention credit.”

- For growing news outlets: An additional $10,000 for each qualified journalist who fills a new journalism position, defined as a net increase in qualified journalists between January 1, 2025 and January 1, 2026. We will refer to this as the “new hire credit.”

When should I apply? (As soon as possible – or else.)

You should apply as soon as the application window opens on February 1, 2026. The credits are first-come, first-served and subject to statewide annual funding limits. If available funds are exhausted (which is likely), later-arriving eligible applications may not be approved.

Is there a cap on how much I can get?

- Yes, a single local news organization can be eligible for up to $150,000 in awards through any combination of retention or new-hire tax credits.

- If the local news organization is part of a chain, total credits across shared ownership entities cannot exceed $250,000 for the chain.

- Total statewide spending is limited to $4,000,000 for retention credits and $1,000,000 for new hire credits annually, with awards provided on a first come, first served basis. Note: In 2025, all $4,000,000 was awarded to local news organizations for the retention credit, so we expect that credit will run out in 2026 too. But the new hire credit did not come close to getting maxed out in 2025, and for now, it seems likely the credit for new hires may not run out in 2026 either.

How much would I get?

Complete this simple calculator to figure out exactly how much you might get. The final award depends on eligibility, documentation, and availability of remaining statewide funds.

- Note: The calculator is shared as a view-only template. To personalize it, make a copy for your own use, then enter your newsroom’s information to see estimated credits.

Do freelancers count?

No, only W-2 employees who work more than 30 hours a week count.

Does nonprofit status matter? I thought my nonprofit didn’t pay taxes or get tax credits.

No. Nonprofits were among the program’s largest recipients in 2025. Nonprofit and for-profit news outlets are both eligible, provided they meet organizational and local-coverage criteria. IMPORTANT: Your IRS filings need to state that part of your mission is to cover state or local news in Illinois.

The tax credit is applied against payroll tax withholdings for employees’ personal income taxes, which nonprofit organizations usually hold for employees. (But the tax credit goes to the organization, not the employee.)

Can small, rural or one-person news outlets receive funds?

Yes! In 2025, a majority of credit awards went to news organizations outside of the Chicago metro area, and two-thirds of the recipient organizations were newsrooms of six or fewer journalists. Seven news organizations with just one qualifying journalist were awarded a credit. The refundable credit is open to all eligible outlets and is intended to support outlets including:

- Small and rural outlets

- Community and ethnic media

- Digital-only publishers

Does this affect other grants or public funding?

No. Receiving the tax credit does not restrict philanthropic funding or other public or private revenue sources.

When will funds be received?

You should hope for the best, but plan for a long wait – in the program’s first year, it took around six months for award notices to go out, and almost a full year after application for some funds to actually show up. (We’re hopeful the process will be speedier in 2026, but it’s better to be careful.) Because the credit is refundable:

- You will likely receive funds after filing your Illinois tax return

- Timing depends on the state’s processing schedule and when you file your taxes.

What documentation will be required?

Publishers might need to additionally provide the following:

- IRS Form 990 (if non-profit)

- Documentation of USPS Periodical Permit (if a mailed print publication)

- USPS Form 3541; PS Form 3526; or a recent mailing statement or invoice demonstrating active use of the permit

- Three sample local news stories (screenshots, PDFs, or links demonstrating original Illinois-focused reporting)

- Analytics report reflecting digital or broadcast audience to show that at least 33% of your audience is in Illinois.

- Publicly-posted Beneficial Ownership or Board of Directors Disclosure

- Financial information showing that the organization has not received more than 50% of its gross receipts in the prior year from PACs, 501(c)4s, or 501(c)6s and has not received more than $100,000 from these entities within any prior year

Who received awards in the first round, and what did awards look like?

Data as of December 2025 show that in the first round of the Local Journalism Sustainability Tax Incentive Program:

- 72 applications were submitted to DCEO

- 55 applicants were approved

- 6 applications are pending

- 11 applications were denied

Among approved applicants, DCEO awarded a total of $4.13 million in refundable tax credits:

- $3.87 million for retaining journalists*

- $260,000 for hiring new journalists

Approved recipients included a mix of nonprofit and for-profit publishers, ranging from small community and rural outlets to larger legacy organizations, reflecting the program’s broad eligibility and statewide reach. Many smaller outlets received $15,000–$45,000, while some larger organizations reached the $150,000 per-organization cap. Two-thirds of the recipient organizations were news outlets of six or fewer journalists.

*After releasing this data, DCEO staff reported that the full $4,000,000 million in retention credits for 2025 had been awarded.

How many years is this program going to be around?

The Local Journalism Sustainability Tax Incentive Program is currently authorized as a five-year program set to run from 2025 through 2029, subject to:

- Annual appropriations

- Legislative renewal or modification

Future availability depends on state budget decisions and legislative action.

What happens if there’s not enough money to go around for all eligible applicants?

Because the program is capped statewide:

- Credits are awarded on a first-come, first-served basis based on when applicants apply

- Once the annual $5 million cap is reached, remaining eligible applicants may not receive funding for that year

Early application is strongly encouraged.

Can universities or student news organizations apply?

Generally, universities themselves are not eligible applicants. In 2025, some university-based public broadcast stations determined they were not eligible for the credit due to being considered state government entities.

However, independent student or community news organizations may qualify if they:

- Operate as a separate legal entity, such as an independent 501(c)3

- Produce original local journalism

- Employ qualifying W-2 journalists working at least 30 hours per week

- Meet audience and eligibility requirements

- For a non-profit, has declared the coverage of local or State news as the stated mission in its 990 filing with the IRS

Final determinations are made by DCEO.

What does “beneficial ownership” mean for this program?

For purposes of the Local Journalism Sustainability Tax Incentive Program, beneficial ownership refers to who ultimately owns or controls a news organization, or who has authority over its governance. This information is used only to verify eligibility and apply statutory caps, not to evaluate editorial content or viewpoints.

Who is considered a “beneficial owner?”

A beneficial owner generally includes:

- Individuals or entities that own or control the organization

- Parent companies or controlling entities, if applicable

- For nonprofits, board members and senior officers who exercise governance control

Day-to-day managers, editors, or employees are not considered beneficial owners unless they also have ownership or governance authority.

Why is beneficial ownership information required?

Beneficial ownership disclosure helps the state:

- Confirm that applicants meet eligibility requirements

- Apply per-organization and per-ownership caps fairly

- Ensure transparency and compliance with state law

It is a standard requirement in state tax credit and grant programs.

How do appeals work if my application is denied or incomplete?

If an application is incomplete or deficient, it may be denied with a written explanation identifying the specific issue(s). Applicants will be given an opportunity to appeal or correct deficiencies by submitting additional or corrected documentation within the timeframe specified by DCEO.

Appeals are intended to address:

- Missing or incomplete documentation

- Clerical or technical errors

- Clarifications related to eligibility criteria