Supporting Local Reporting in Illinois: Early Lessons and Opportunities

In 2025, the Local Journalism Sustainability Tax Incentive Program awarded $4 million in tax credits, supporting over 260 journalist jobs across more than 120 local outlets statewide. Early implementation of the policy reveals opportunities to better target funding, expand eligibility and simplify participation

Executive Summary

The United States has lost about 75% of its local journalists since 2002, leading policymakers and advocates in many states to call for public policies that support local news production. In 2025, Illinois pioneered the nation’s first refundable tax credits for local news, making it more affordable for news outlets to hire and retain journalists.

In its first year, the Illinois Local Journalism Sustainability Tax Incentive Program created by Senator Steve Stadelman awarded more than $4 million in tax credits to support more than 260 local journalist jobs at 55 news entities operating more than 120 local outlets across the state: newspapers, digital news sites, broadcasters, commercial and nonprofit newsrooms alike. Policymakers in several other U.S. states have introduced or are considering similar programs.

To examine the Illinois program’s implementation and identify areas for improvement, Rebuild Local News, which supported and helped design the original legislation, prepared this implementation analysis.

Our research is based on state data obtained through public records requests; consultation with stakeholders; and 18 semi-structured interviews in late 2025 following initial awards and partial disbursement of credits. We gathered perspectives from technical experts on the tax credit, membership organizations representing news outlets, state officials responsible for implementing the program, and news publishers – including some who were awarded a credit, some who did not apply, and some whose applications were still pending or had received no response.

Key findings

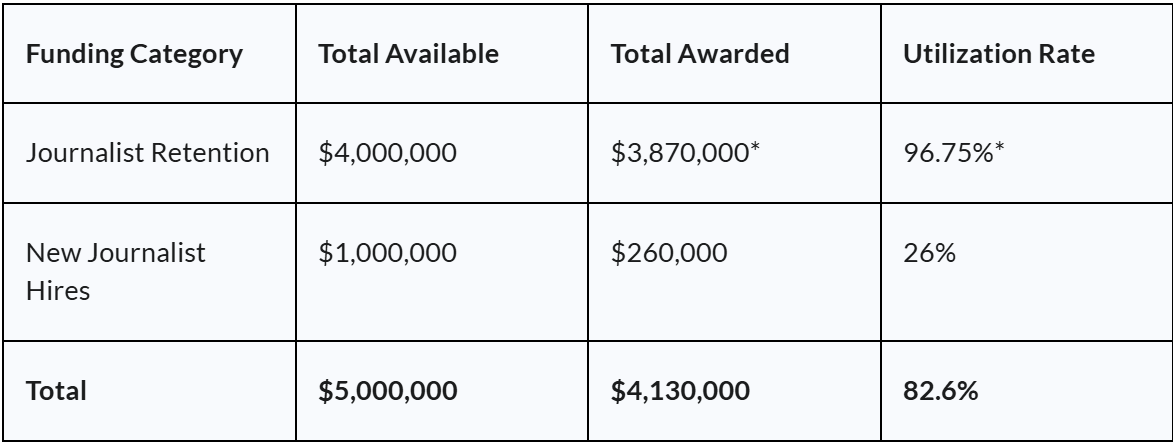

- Distribution of the total program funding showed success but also opportunity for improvement. The $4 million allocated to the program’s credit for existing journalist jobs ($15,000 per journalist) was fully claimed. In contrast, only 26% of the dedicated $1 million fund for a new jobs credit ($10,000 per new journalist hire) was claimed.

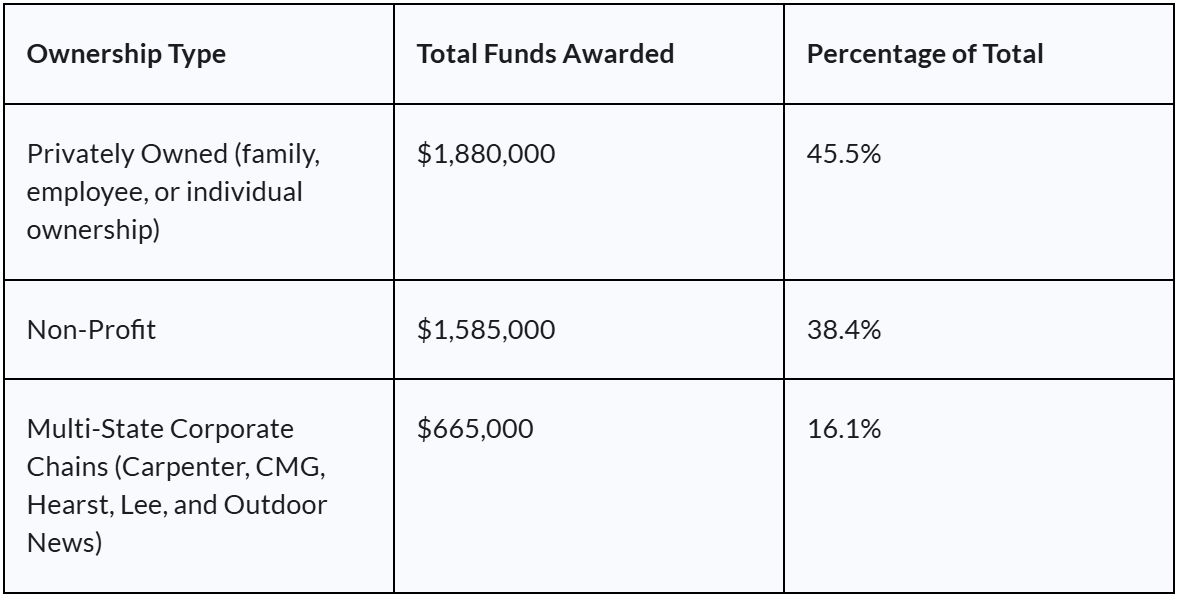

- A broad range of news outlets received funding, primarily smaller publishers, across all parts of the state. A majority of funds were awarded to news organizations outside of the Chicago metro area, and more than one-third went to non-profit news organizations. Larger news organizations did not monopolize program awards: Two-thirds of the recipients were small news outlets of six or fewer journalists. Seven news organizations with just one qualifying journalist were awarded a credit. Only 16.1% of funds were awarded to organizations we identified as multi-state commercial chains.

- The program showed no signs of political interference with awardees or benefits going to low-quality, partisan “pink slime” outlets. The program’s formula design and implementation raised no known allegations of government officials picking winners and losers or making content-based distinctions between news outlets. At the same time, the program’s beneficiaries do not include any obvious low-quality spam or “pink slime” outlets. These factors suggest a high-integrity and First Amendment-friendly subsidy design that can be scaled up as funding allows.

- Publishers say the program has already been protecting journalist jobs and leading to expanded coverage. While direct impacts are difficult to evaluate because funds were only recently distributed at the time of this analysis, struggling news organizations reported plans to expand coverage, increase journalist pay and upgrade outdated equipment because of the program. A larger publisher said the credit “allowed us to… save jobs and roles that we did not have to make cuts for.” A small publisher spoke to its potential attracting other support: “I could use this as a jumping off point for fundraising for this particular position. It’s almost like a match at that point.”

Opportunities for improvement in statute and implementation

The program’s foundation is solid. Because our research was largely conducted before funds arrived in bank accounts for many local news outlets, this report will focus on opportunities we identified for strengthening statutory design, agency implementation and journalism support organization education efforts. Program impact – the full effects of dollars arriving for dozens of local news organizations – will require further research.

Until then, our recommendations for statutory refinement include:

- Recalibrate the hiring incentive for more efficient use of total funding

- Broaden eligibility to better cover the local news ecosystem, such as adding support for university-based public media

Our recommendations for agency implementation refinement include:

- Improve outreach and upfront communication to reach more news organizations

- Adjust the handling of certain payroll situations to reduce administrative barriers

Our full set of recommendations for improvement is listed at the end of this report.

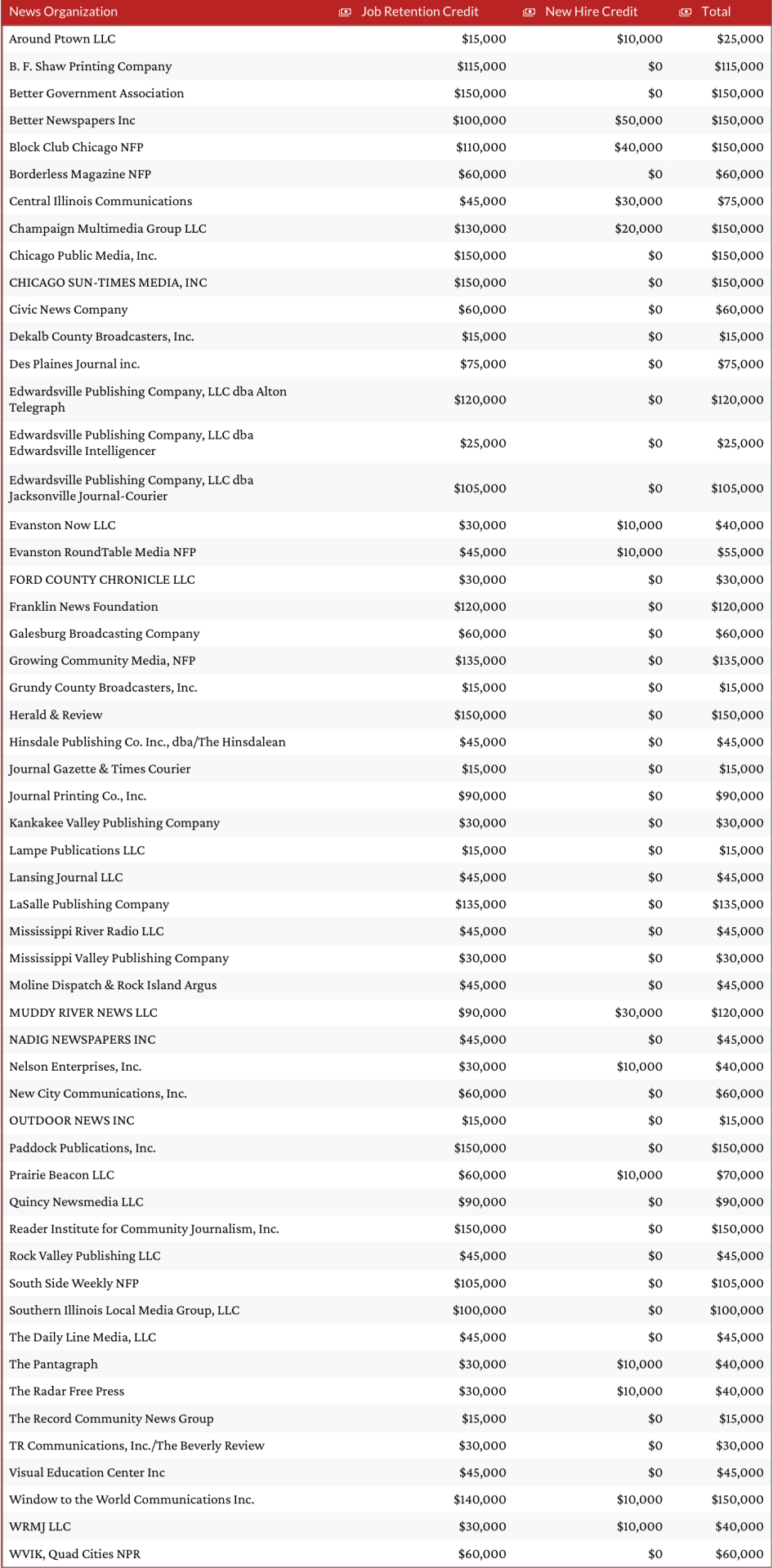

Year One Credit Recipients and Awards*

*As of December 9, 2025, DCEO data provided in response to a public records request by Northwestern University.

1. How The Program Works

The Local Journalism Sustainability Tax Incentive Program (created by the Local Journalism Sustainability Act, 35 ILCS 18) narrowly targets public dollars to support local news production through refundable payroll tax credits for journalist retention and hiring.

The program offers two types of refundable tax credit for eligible local news organizations, applied against their payroll withholding of employees’ personal taxes under Article 7 of the Illinois Income Tax Act. This design benefits non-profit news outlets – a critical segment of the evolving local news ecosystem – on the same terms as commercial outlets, while the formula approach limits agency overhead and chances for government interference with news organizations’ editorial choices.

The two tax credits are:

- An existing jobs credit worth $15,000 for each qualified journalist employed by the organization during the past 12 months.

- An additional new jobs credit worth $10,000 for each new journalism position created in the year prior to the application period.

To qualify for either the existing or new jobs credit, a qualifying journalist position must be full-time (at least 30 hours per week) and must include a journalistic function. The qualifying journalist must be on an organization’s payroll as a W-2 employee, not a freelancer or other contractor. They must live within 50 miles of the coverage area.

Local news organizations must also meet these criteria to be eligible:

- For a print publication, published at least monthly over the past year and holds a valid USPS periodical permit or have at least 25% of its content dedicated to local news;

- For a digital publication, published at least weekly over the past year and shows at least 33% of its digital audience in Illinois;

- Publicly discloses its beneficial ownership or board of directors;

- For a non-profit, declares coverage of state or local news in its IRS Form 990 mission statement;

- Has not surpassed defined limits for revenue from 527 political action committees, 501(c)(4)s, or 501(c)(6)s.

An important feature of the tax credits is their refundability. If the value of the awarded credit exceeds an organization’s payroll tax liability for a given reporting period, the state refunds the excess amount directly to the organization, akin to a grant. The effect is a direct cash infusion to support news operations, including for many small and non-profit outlets with limited tax liabilities but significant payroll costs. As one recipient said, “It will be our second largest revenue stream for the year… about 15% more. So that’s a sizable impact on our ability to cover the community.”

2. The Split in Funding

Retention grants were fully subscribed, but most new hire funding went unused

The program authorizes up to $25 million in funding over five years. The $5 million for each year was divided into two credits: $4 million for retaining existing “qualified journalists” and $1 million for new hires. Credits are distributed on a first-come, first-served basis until the funding cap is reached.

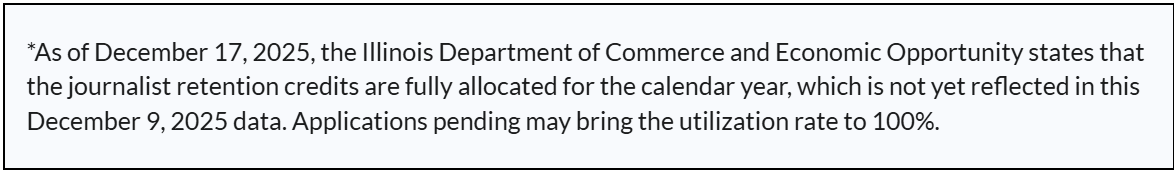

According to the Illinois Department of Commerce and Economic Opportunity (DCEO), the full $4 million for retaining existing journalists has been allocated for 2025, while only $260,000 of the $1 million available for hiring new journalists was claimed, leaving about three quarters of the hiring funds unused.

In 2025, 73 entities applied for the tax credit, according to data provided by DCEO in response to an open-records request from Northwestern University. As of that data release on December 9th, 2025, fifty-five outlets have been approved to receive a credit, eleven were denied, and six are still pending.

DCEO did not share the names of organizations that had their applications denied. But a DCEO spokesperson said that reasons for denial implicated three statutory rules: “a non-profit’s Form-990 not disclosing [a focus on] local or state news, audience analytics below the 33% of audience in Illinois threshold, and [political action committee] income over the allowable threshold.” RLN independently learned that one multi-state nonprofit news publisher was denied tax credits by DCEO on grounds of not being an Illinois-specific local news publisher, with the agency citing a lack of audience concentration inside Illinois and a lack of an Illinois-specific state or local news focus declared in the publisher’s IRS Form 990 (as required by statute).

Through analysis of the program, interviews with local publishers, and consultation with other stakeholders, we identify several factors that may have contributed to under-subscription of the new-hire benefit:

- A one-time hiring subsidy may not be enough to entice financially fragile news organizations that may struggle to sustain a permanent payroll increase. The new-hiring tax credit offsets a portion of the first-year cost of a new journalist’s wages, but the organization may bear the full, ongoing salary liability in subsequent years without that subsidy. In a tough business environment for local news, organizations fear that revenues generated by a new role will not cover long-term employment costs. Some publishers accordingly reported they were not confident in their ability to sustain a new hire with the one-time benefit. As one publisher of a neighborhood newspaper said, “The amount of the [new hire] grant would not be enough to sustain a salary person the entire year. We’re hanging on by a thread.” Another recipient said that the funds would push a decision over the edge on a new hire “in normal times,” but they still face headwinds in a precarious industry and economic landscape.

- Outlets had a limited window to hire in 2024 while knowing this benefit was available. This may be a temporary, one-time issue related to the timing of the program’s creation in 2024 and its rapid implementation in 2025. The credit for a new journalism position required that an outlet show a net increase in journalists from January 1 of the preceding calendar year compared to January 1 of the current year. However, the program did not become law until halfway through 2024, and media outlets were motivated to apply as early as possible in 2025 due to the first-come, first-served criteria. That left only a few months to become aware of the benefit and hire new journalists based on the expectation of receiving it.

- As a new program, the hiring benefit was not widely known. With the success of the program attracting more attention, outlets may find more incentive to hire and apply for the new hire grants before the 2026 application deadline, including making fundraising pitches based on the state’s offer of what would effectively be matching dollars for new hires. While publishers did not describe using the tax credit as a formal philanthropic match in 2025, several noted that it reduced risk around grant-funded hires, extended runway beyond grant periods, and increased confidence in staffing decisions. Over time, this suggests potential for the credit to function as a complementary layer alongside philanthropy.

Going into Year Two of the program, issues #2 and #3 are likely to recede in significance. Publishers who received a credit in year one indicated that it had impacted their thinking for 2026 and beyond. Other publishers may be enticed to apply now that they can see that the program is working to deliver funds to news organizations. However, issue #1 remains a concern and may require adjusting the credit to better reflect economic challenges of local news.

3. Public Funds Were Broadly Distributed

Credits were awarded to a variety of outlets across different geography, size, ownership, and media-type, with some notable absences

The program reached a wide cross-section of the state’s media ecosystem. The list of recipients (attached in the Appendix) includes small, locally-owned LLCs, non-profits, larger media corporations, and some but not all public broadcasters. It reflects a blend of commercial and noncommercial journalism models. The overwhelming majority of these organizations are focused on community and local-level news coverage, from specific neighborhoods in Chicago to entire counties and in-state regions. A small number have a statewide or state capitol focus.

A wide geographic reach

While a significant cluster of organizations in the Chicago metropolitan received the maximum allowable credit (e.g., Block Club Chicago, Chicago Public Media, Chicago Sun-Times), over half of the funding went to outlets serving smaller cities and regions located outside the Chicago metro area, demonstrating statewide reach, according to an analysis by the Medill Local News Initiative and Northwestern University. Examples include the Galesburg Broadcasting Company, Quincy Newsmedia, and the Southern Illinois Local Media Group.

Most recipient news organizations were small

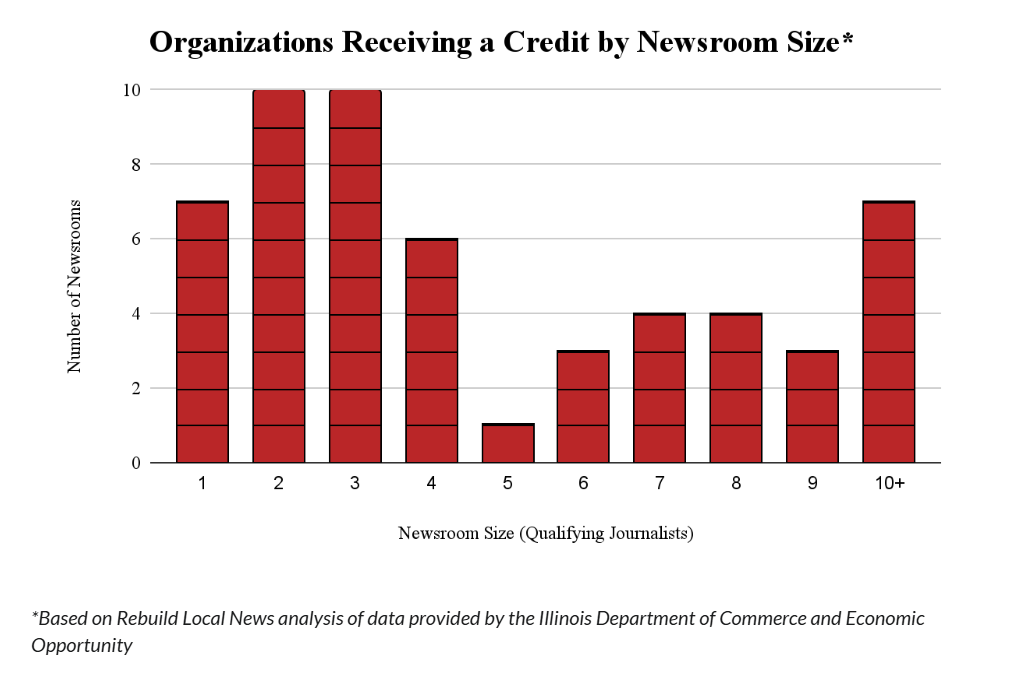

The program’s benefit was effectively spread across news organizations large and small. Although a handful of larger news organizations claimed the maximum allowable dollar awards – reflecting their roles as the largest employers of local journalists in Illinois – the statute’s caps on per-organization benefits meant smaller news organizations could subsidize a much greater percentage of payroll expenses.

As the below chart shows, two-thirds of the recipient organizations were news outlets of six or fewer journalists that qualified for less than $100,000 in credits each. Seven news organizations with just one qualifying journalist were awarded a credit, demonstrating that the smallest news organizations could qualify.

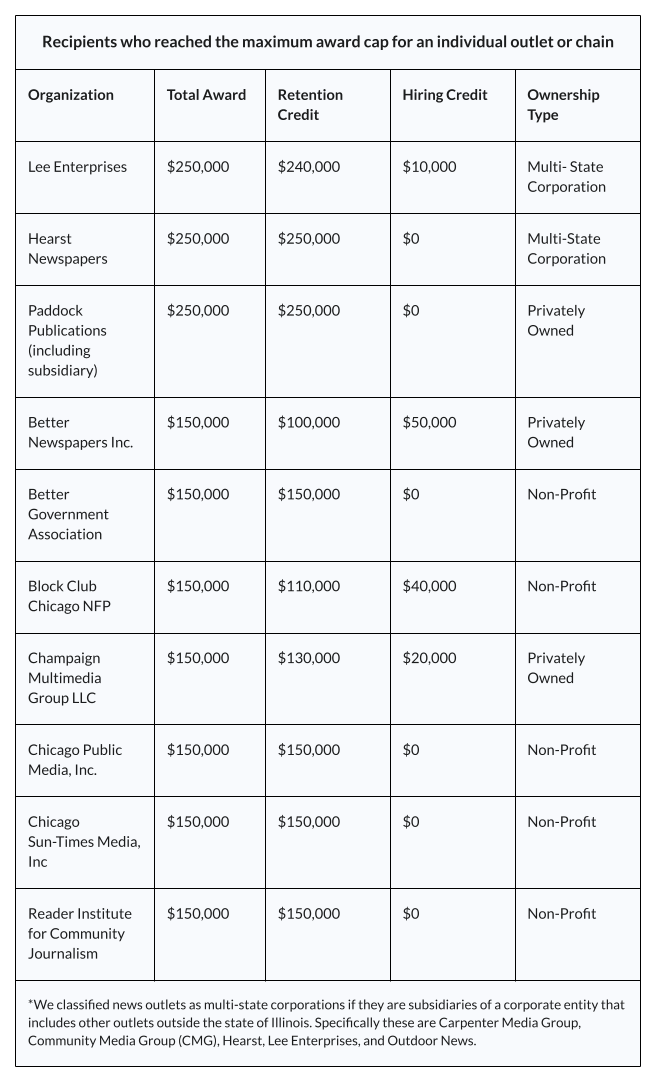

Among larger news outlets that received the maximum credit amount, the program showed diversity in media type and ownership. Three newspaper chains received the maximum $250,000 benefit, and 10 individual outlets received the maximum $150,000. These include multi-state corporations*, individual or family-owned private businesses, and non-profit organizations, operating across print, digital, and broadcast news media.

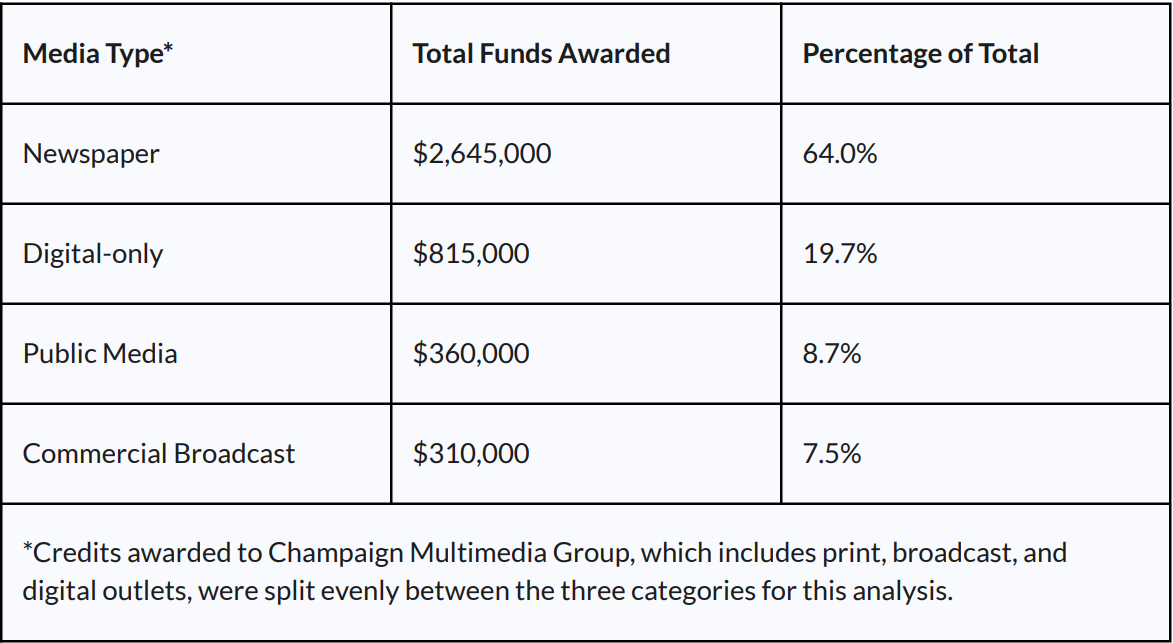

Most funds went to local newspapers (which make up most local news outlets)

The program reached a mix of media types. Traditional newspapers — which increasingly provide news through digital platforms such as websites and social media as well as print — were the largest beneficiaries, capturing close to two-thirds of the awarded funds, reflecting the reality that more than two-thirds (68%) of the local news outlets in the U.S. in 2025 were newspapers. The remainder of funds were split between broadcast and digital.

While the text of the law does not specify broadcast content as qualifying journalism, DCEO has stated that broadcasting is considered a form of digital publishing for the purposes of this program. A variety of radio broadcasters were allocated credits, including public radio affiliates like WVIK, Quad Cities NPR and commercial groups like Dekalb County Broadcasters.

Funds overwhelmingly went to community-based operators

Closely held private enterprises (such as family- or employee-owned news companies) were allocated the largest share of the funding, followed closely by non-profit organizations, which received over a third of the money despite being a smaller minority of outlets in the state. These early signs show the program can be effective at supporting both traditional community papers and the growing non-profit news sector.

Sole proprietors with pass-through (non-wage) income from their business were not eligible for the program because the tax credit is tied to payroll taxes for employees with a W-2 form. However, at least one publisher successfully reorganized their business to pay themselves as a W-2 employee and receive a credit.

Notable absences among corporate chains, public broadcasters, and ethnic media

Despite the broad diversity among program participants, a combination of eligibility restrictions, administrative challenges, and accessibility of information about the program caused underrepresentation in a few segments of Illinois’ local news ecosystem.

One notable absence was university-based public media stations, which may not be statutorily eligible to receive tax credits as units of state government entities, a question that needs further research. RLN learned that it was the interpretation of at least one public Illinois university that their public media station does not qualify under the statute. Other university-based stations chose not to apply following that analysis. Opening the program to these entities may require a clarification by the state or a statutory fix, included in our recommendations at the end of this report.

Another absence was the major network affiliated commercial television news stations, as well as two of the nation’s largest newspaper chains, Gannett and Alden Global Capital, both of which have a presence in Illinois. The identity of declined applicants has not been released by the state, so we do not know whether they chose not to apply or were denied.

Because our interviews focused on other types of local news organizations, we can only speculate as to why commercial broadcast stations might not have applied or were denied funds in 2025. Trade officials representing commercial broadcast stations said they were unaware of any program issues that caused stations not to apply in 2025 and hoped participation would increase in 2026. The program’s statutory limit on receiving no more than $100,000 from PACs, 501(c)(4), or 501(c)(6) entities within any taxable year could disqualify some commercial organizations that carry a significant amount of political advertising.

The criteria under the law that local news organizations must have published at least one print publication per month over the previous twelve months or at least one digital piece about the community per week over the previous twelve months creates a lack a parity between print and digital outlets and appears to have excluded at least one news organization that serves important community needs, as an exchange between the news organization and DCEO (see the “Publishing Standards” section beginning on page 6 of linked document) illustrates.

Ethnic media and Spanish- or other non-English-language news organizations were underrepresented in the program despite apparent statutory eligibility. Only one recipient appears to be in this category, the non-profit Borderless Magazine, which focuses on immigrant communities in Chicago. Our interviews found a combination of factors at play that could be resolved with greater outreach and assistance. One ethnic media outlet is a subsidiary of a larger corporation and reported lacking guidance on how to navigate the program’s rules as they related to chain ownership: in particular, the statutory financial disclosure requirements, which limit the percentage of revenues that can be taken from political action committees and 501(c)(4)s. The outlet did not know whether to calculate that figure at the corporate or subsidiary level and decided not to apply in 2025, but plans to in 2026. Other ethnic media outlets experienced the same challenges that led many eligible small news outlets not to apply: unfamiliarity with a new program and limited capacity to navigate application and eligibility questions. We discuss these broader challenges in more detail in the next section.

The sole proprietor issue clearly affected some news organizations, as several of the questions from prospective applicants shared by the Illinois Department of Commerce and Economic Opportunity dealt with this issue. At least one publisher we spoke with was able to reorganize the news organization to provide themself with a wage income rather than corporate pass-through income and thus qualify for the payroll-based refundable credit.

4. Participant Experiences

Early rollout challenges were mitigated by DCEO’s flexibility and responsiveness

The program’s inaugural year required state agencies and news organizations, respectively, to quickly build and navigate a new system. The program was signed into law in June 2024, leaving just six months to prepare before the first-come, first-served application window opened in early January.

Considering the time pressure, state agency officials did an effective job of guiding applicants through the process. A consistent theme across interviews was that while the process had friction, the personnel at DCEO and the Department of Revenue were helpful partners. Multiple publishers noted that once they connected with a specific contact at the state, the support was high-quality and effective. One recipient described it, “Once I got to a real person, she understood the process … and was quite helpful.”

Several applicants described the core application form as “brief” and “manageable.” However, some reported struggling with unclear or unfamiliar terms (i.e., financial reporting definitions, beneficial ownership, political advertising-related questions).

News organizations perceived that the program delivers tangible results if applicants can meet the requirements. One publisher said, “We did appreciate that the definitions of qualified journalists were broad, and that the application overall was brief and straightforward.”

Intermediaries were key in efforts to educate publishers

Publishers learned about the credit through a patchwork of channels. For organizations that applied, our analysis showed that DCEO officials effectively guided them during the process. However, a lack of clear upfront information prevented some small outlets from applying at all. A FAQ from the state existed but was said to be hard to parse for many publishers. Webinars were helpful but insufficient alone.

As one publisher said, “It was announced that they had passed this great thing. And everyone was like, cool — when do we apply? What documentation are you going to need? And nobody knew.”

Intermediaries played a key role in outreach. The Medill School of Journalism, Illinois Press Association (IPA), the Institute for Nonprofit News, Local Independent Online News (LION), and Rebuild Local News each provided communication about the program to their respective members, as well as developing publicly available resources.

Notably, philanthropic support from The Joyce Foundation allowed IPA to contract with an attorney and tax accountant to provide application support at no charge to publishers, whether or not they were IPA members. The attorney and accountant were available for hotline calls and individual consulting, and multiple publishers reported that they were helpful with the application process. IPA and Medill also hosted two webinars open to anyone interested, with more than 60 attendees in the webinar just before applications opened.

Attempts to form an advisory board with representatives from all trade groups with eligible members, including commercial broadcasters, did not move beyond early discussions. Coordination among these and other intermediaries for consistent, shared messaging could extend the reach of outreach efforts shown to be successful in year one.

Some smaller organizations struggled with paperwork

An endemic challenge for the local news sector for any public policy is that many small news organizations don’t have the organizational capacity or expertise to quickly learn about and navigate new programs. In 2025, the program’s rapid rollout, brief application window, and limited initial guidance left little runway to alleviate this basic structural challenge.

These barriers were not insurmountable for all small news organizations, which made up two-thirds of tax credit recipients in 2025. But some small publishers said they faced barriers that larger organizations with legal guidance and in‑house finance teams and reported finding manageable.

Many smaller outlets lack sophisticated (and sometimes basic) finance and legal capacity, and the time burden to navigate uncertainty and questions was a real deterrent. As one publisher said, “Many founders aren’t seasoned business operators – they’re learning as they go.” Another small Chicago-area publisher said, “Capacity and time were the biggest barriers. It wasn’t obvious that the credit was meant for outlets like ours.”

One change that may help with this issue in 2026 is that DCEO says they will no longer require a local news organization to provide detailed financials if the organization has zero income from political action committees.

An unexpectedly long process without a clear timeline

Some news organizations were surprised by the lengthy timeline between application and receipt of funds, which in some cases lasted a whole year. This was partially due to natural delays of a program being implemented for the first time and partially a requirement of a multi-step process for disbursement.

First, news organizations must apply and provide the required information to DCEO at the beginning of the year. Once DCEO reviews the information and receives any needed clarifications from the applicant, they issue a credit certificate of eligibility or a denial. Organizations can apply the certificate to their next quarterly tax filing (this was the step that proved difficult for many outlets using external payroll providers). Funds are then delivered in the quarter after that, either by reducing payroll taxes, being issued as a check, or a combination of the two. In year one, this meant that when news organizations submitted their applications in January, most received a certificate showing their award amount by July; they could apply the certificate to their next quarterly tax filing due in October; and they received payment in November or December. A DCEO spokesperson said the department anticipates a similar timeline in 2026.

The State should provide timely and accurate information to help news outlets better understand the program and align their expectations and budget planning. As one publisher said, “Advance notice and predictable timelines would make a huge difference.”

Payroll processors presented an unexpected challenge

A significant friction point came from third-party payroll processors. Many news organizations, especially small and medium-sized organizations without internal finance and HR staff, contract with payroll processors such as Gusto and ADP to manage their payroll system, withhold taxes, and calculate deductions and credits. Under the program, when a credit certificate was awarded to a news outlet that uses a payroll processor, the outlet had to ask the third-party processor to apply the certificate to their next quarterly payroll tax filing in order to receive funds.

Several publishers reported that major payroll processors were unprepared to handle the specific filing requirements of this program, with one payroll processor incorrectly flagging it as a business tax credit rather than a payroll credit. This confusion led to incorrect filings and the need for amended forms, further delaying the receipt of funds. Consequently, many publishers were still waiting for the funds to appear as of late November.

DCEO has responded to this issue with helpful guidance, including in limited instances sending publishers the full amount of the credit by check when applying the credit to a payroll tax filing was too much of an obstacle. More upfront guidance both to publishers and payroll processors could alleviate this problem in the future.

Going forward, a spokesperson said DCEO has worked closely with the Illinois Department of Revenue to address these challenges and will continue to provide support. If applicants experience difficulty applying credits through their payroll processor, DCEO said the department will work directly with the applicant to resolve the issue.

Fear of making a mistake prevented some outlets from applying

Many publishers, especially small and non-profit outlets, reported initially assuming incorrectly they were not eligible, or delayed applying due to fear of repercussions for making mistakes on the applications. As an urban non-profit publisher said, “We didn’t want to take the legal risk of filing inappropriately without clarity.” More upfront communication by DCEO about the process and assurances that good faith mistakes on the application would not be penalized could help attract these smaller organizations to apply.

How funds are expected to be spent

We don’t have firm answers on how funds are being spent by news organizations yet, because while the credits have been allocated, checks have just begun to go out as of this writing in January 2026. Although the program allocates funding to news outlets based on employment levels, the cash received by recipients via refundable credits does not come with limits on how it can be spent, whether on payroll costs or other needs for the news organization.

Publishers did speak in general terms about how the credits would support their work. For many publishers, the most important effect is stabilizing their workforce and helping to grow their coverage, though not usually to the point of adding a new full time person.

“Payroll is our biggest expense as a small newspaper,” said a suburban non-profit publisher. “The credit is a lot of money to us. It will help pay our freelancers. We have a lot of requests for coverage that we are not able to respond to, but if we can expand our freelance team and get them out to more events, that will help our community.” A small digital publisher in the Chicago-area said, “We applied because any support that helps us retain journalists is meaningful. Even relatively modest amounts can make the difference between keeping someone on staff or not.”

Another small publisher spoke about supplementary support for coverage like increasing the pay for an open editor position, updating computers, and purchasing a new camera.

For several news outlets, the program was already influencing decisions to add journalist positions. One recipient said that the program had “at least informed decisions to make another hire and as well as add a medical package this year.” An urban non-profit publisher that received new hire credits said, “Having a financial incentive to hire new journalists can often help news organizations make the tough decision to add costs, knowing that at least some of the salary could be funded. We all have to figure out long-term plans to pay for every position, but knowing a credit can be applied in year one could very well swing the decision in favor of putting more journalists on the beat.”

5. Recommendations

Our analysis of the program’s inaugural year provides encouraging evidence of success as well as areas for targeted improvements. The following recommendations address the specific shortcomings identified, enhancing the program’s ability to foster a more resilient, equitable, and sustainable local news ecosystem in Illinois.

Recalibrate the hiring incentive for more efficient use of total funding

The underutilization of the $10,000 hiring credit suggests its structure needs to be realigned with the financial realities of news organizations.

- Increase the Credit Value for New Hires and create tapered two-year subsidy: To overcome the risk aversion associated with new payroll commitments, the per-employee credit for a new hire should be made at least as much as the credit for a retained employee ($15,000). The state could explore converting the hiring credit into a two-year tapered subsidy. For example, a new hire credit could continue in a smaller $10,000 credit in the second year, easing the organization’s transition to bearing the full payroll liability.

- Adjust or remove the organization cap for new hire credits: If job growth happens at larger news organizations, the $150,000 cap per outlet may exclude some new hires from being subsidized and contribute to chronic underutilization of the new-hire credit. This could be addressed by exempting new hire credits from the program’s per-organization cap or by creating an independent cap for new hire credits so that organizations can receive the maximum amount from both buckets of funding. DCEO could also prioritize awarding all applicable new hire credits before retention credits when outlets are eligible for both programs, to ensure the new hire funds are utilized as much as possible.

Broaden eligibility to better cover local news ecosystem

While the program effectively reached a broad range of news outlets, adjustments to program eligibility could help bring support to some of the notable exclusions.

- Create an alternative pathway for one-journalist outlets. The exclusion of sole proprietors such as solo journalists who work via pass-through corporate entities presented hiccups for a vital and growing segment of the news ecosystem. The statute could be amended to establish that sole proprietors and single-member LLCs that meet the program’s publishing and local content standards may receive a credit as long as they can provide evidence that they are working full-time as a journalist. This would likely require an amendment to the statute to credit entities with no payroll tax liability. A standalone credit, equivalent to the value of employing one qualifying journalist in the existing program, could be available to sole proprietors with at least $35,000 in passthrough income and no qualifying journalist employees.

- Adjust frequency requirement for digital news organizations. The weekly publication requirement for digital media excludes innovative, high-impact journalism models that publish a handful of substantial, long-form, or investigative pieces per year (e.g., 10-12 major projects). A monthly frequency requirement would establish parity with the requirement for print publications. The program could also make it easier for digital publications to establish eligibility by clarifying that newer publication models like email newsletters and podcasts can meet the frequency requirement.

- Clarify eligibility for university-based public media. While independent non-profit public media organizations successfully applied for the credits, university-based public media stations did not. The statutory requirement that an eligible non-profit declare coverage of local or State news as the stated mission in its filings with the Internal Revenue Service excluded many of these outlets from the program, as they are organized within a larger entity that does not reference news in its mission. This issue could be addressed by amending the statute to include State Governmental Education Agencies that own a public broadcasting license or creating an equivalent appropriation to support these outlets.

Improve upfront communication and reduce administrative barriers

The most common improvement requested by publishers interviewed is to have better advance communication, timelines, and guidance for applicants. Journalism support organizations also have a critical role in helping educate smaller publishers in particular about the program or even assisting with engagement. Building on the lessons of the first year, our recommendations to improve program accessibility include:

- Provide additional materials to improve accessibility of the program, especially for small publishers with less capacity for understanding new financial and legal processes. These could include example applications; a clear timeline with expected dates for certificate awards, credit filing, and funding distribution; and plain language fact sheets on who is eligible. DCEO and the Illinois Department of Revenue could also provide additional dedicated support for small publishers and assurances of safe harbor against penalties for good faith mistakes.

- Permanently push back the application deadline into February to better accommodate budget cycles and news organization capacity (as has already been done for 2026). Opening applications in a first-come, first-served program in early January, as occurred in 2025, created some dilemmas for news organizations. Some publishers had not fully completed their accounting for the previous year, so they faced difficulty compiling all of the information required for the application in time. The application deadline also hit around a time when many of the staff needed to complete it would have been out on holiday. DCEO has already addressed this issue by announcing that the next year’s deadline will be February 1, and we encourage the state to continue with that practice. A DCEO spokesperson said the department plans to open applications on February 1 in future years unless new trends emerge as the Department navigates best practices in implementing this program.

- Provide active guidance and alternative funding distribution to support news organizations that use external payroll services. A frequently noted hurdle among publishers we spoke with was with getting the external company that manages their payroll filing to appropriately apply the credit certificate so that checks could be delivered by the state. While self-filing news organizations could do this without significant problems, organizations that used larger payroll providers (i.e. Gusto, ADP) frequently could not get the provider to apply the certificate on their behalf. The state eventually found a workable solution by allowing the news organization to file an amended return and then sending a check directly to the news organization. However, this further delayed receipt of credits and worked against the purpose of the program to provide efficient and timely support of local news. On the regulatory side, the state could provide more upfront guidance for news outlets that use a payroll service provider, including a choice to opt in to direct payment without going through the external payroll provider. The Legislature could also explore strengthening the statute to require participation by payroll providers.

Other improvements

We identify a few areas of improvement that, while not emerging directly from this implementation analysis, may be relevant for the program going forward.

- Consider creating a priority waitlist or pro rata distribution if the program is oversubscribed and boosting program funding is not an option. Program takeup is likely to increase in 2026, raising the prospect that eligible news organizations may apply and be turned away due to oversubscription of the retention credit. In the case that news outlets miss out because they have less administrative capacity to complete an application before program funds are exhausted, that state could create a priority waitlist that puts these organizations first in line to receive credits in the following year as long as they still meet all eligibility requirements. Alternatively, the state could set a window to receive applications and then distribute funds on a pro rata basis (meaning a smaller credit per journalist, with the risk of diminished effectiveness if the program is heavily oversubscribed). There are tradeoffs with either approach that should be discussed with the news community before proceeding.

- Study a tax credit exchange or a similar concept that allows credits to be monetized more quickly. For many struggling publishers, when the money arrives matters as much as how much. Smaller outlets are chasing near‑term cash, and delays create operational stress. Some publishers expressed interest in selling credits at a discount before delivery from the state to help with cash flow. This idea has precedent in Illinois and other states, such as the Illinois Film Production Tax Credit, which is transferable to other recipients on payment of a small fee to DCEO. This matter requires further discussion and study before a formal proposal is made, as the concept has not been attempted specifically for the local news community. The state and journalism support organizations could explore options including setting up a tax credit exchange for this purpose, potentially in partnership with a local journalism-focused philanthropy or coalition so that profits from the exchange can be reinvested back into local news. A community news investment fund could also help act as a bridge financier or intermediary.

- Tie tax credit eligibility to compliance with Illinois’ 120-day sale notice law, which currently lacks enforcement. One news organization that was awarded $150,000 from the tax credit program, including $100,000 in retained employee credits and $50,000 in new hire credits, subsequently sold eight of its Illinois newspapers to an out-of-state company with a history of layoffs at newly acquired papers. This sale appears to have been done without giving a statutorily required notification to local government or newspaper employees. However, the 120-day law does not include any enforcement mechanisms or penalties for noncompliance. Clearer enforcement consequences should be established by linking the employment subsidy to compliance with the 120-day sale notice law: a news organization and successor organization party to a noncompliant transaction should be ineligible for receiving employment tax credits in following years.

6. Conclusion

During our interviews, news organization leaders separated strong policy intent from fixable implementation barriers, and many see the credit as proof that state support can be structured without compromising the principles and values of independent journalism. On the whole, the objective criteria and formula-based distribution effectively and fairly allocated funds to local news outlets. “I think the way it was structured [to spread support across small and mid-sized local publishers] was brilliant,” said one recipient.

The Illinois Local Journalism Sustainability Act stands as a landmark piece of legislation, offering many lessons for the future of public support for news. The program is delivering millions of dollars in support to a wide array of new organizations across the state. This investment in news strengthens Illinois communities with trustworthy local information. With iterative improvement based on the data and lessons from the first year, the program can become even more effective at cultivating the resilient, locally-rooted, and sustainable news ecosystem that Illinois communities deserve.

Acknowledgements

For their assistance with this report on the Illinois Local Journalism Sustainability Tax Incentive Program, we extend thanks to Senator Steve Stadelman, The Joyce Foundation, Illinois Press Association, Medill School of Journalism at Northwestern University, Press Forward Chicago, Institute for Nonprofit News, Local Independent Online News Publishers, Illinois Broadcasters Association, Illinois Public Broadcasting Council, Public Narrative, Chicago Independent Media Association, and Illinois Department of Commerce and Economic Opportunity.

Most importantly, we thank the publishers who shared their scarce time with us to discuss their experiences in hopes that greater understanding will lift all boats in the local news community in Illinois and beyond. We anonymized their quotes to allow for candor in this report.

Authors

This report was authored by Rebuild Local News Senior Policy Manager Gene Perry with additional research by Caroline Ross of Valentin Company. For questions or comments, please contact geneperry@rebuildlocalnews.org.