Application Guidance: Illinois Journalism Payroll Tax Credit

A step-by-step guide for Illinois newsrooms, including an eligibility checklist, a credit calculator to estimate potential awards and resources to help you complete the application successfully

FAQ | Application Guidance | Application Examples

How to Apply

Visit the Program Application Portal

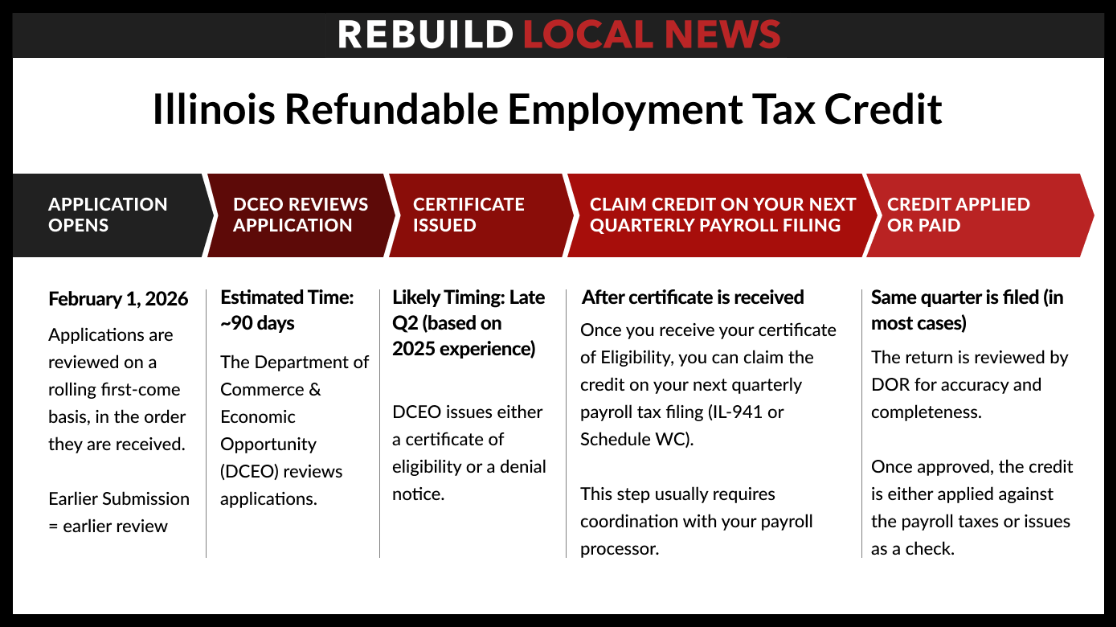

- The Illinois Department of Commerce & Economic Opportunity (DCEO) hosts the program and maintains the digital application. You can start the application online through the DCEO portal. The application window will open on February 1, 2026.

- Credits are awarded on a first-come, first-served basis each year. Once the annual cap is reached, applications may remain open only for the “expansion/new hire” bucket until those funds are exhausted. If you missed the 2025 allocation for existing staff, you can still prepare for the 2026 cycle especially if you are hiring or expanding newsroom capacity. Plan to submit promptly after the January 2026 opening to secure credits before funds are exhausted.

Prepare Required Materials

Typical items you’ll need include:

- Employer Identification Number (EIN)

Payroll records for qualified journalists (W-2 staff averaging at least 30 hours/week) - Documentation showing original local journalism produced

- Any required certifications or declarations as specified in the program guidance (e.g., newsroom role descriptions)

- An organizational chart showing all companies or entities connected to your organization (i.e. who controls you, who you control, other companies under the same control)

- If using a Professional Employer Organization (PEO), a copy of the PEO agreement

Submit the Application

The application is submitted electronically through the DCEO’s form portal.

Receive a Tax Credit Certificate

If approved, the department issues a Local Journalism Tax Credit Certificate stating your approved credit amount. That certificate is what you attach to your Illinois tax filing for the appropriate quarter.

Apply the Credit

Use the certificate when filing your Illinois tax return. The credit is applied to the first full quarterly reporting period after the certificate is issued. Reporting period means the quarter itself (not the filing deadline window).

Examples:

- If your certificate was issued during Q1 (January–March), you will apply it to your Q2 return (April–June).

- If your certificate was issued during Q2 (April–June), you will apply it to your Q3 return (July–September).

- If your certificate was issued during Q3 (July–September), you will apply it to your Q4 return (October–December).

- If your certificate was issued during Q4 (October–December), you will apply it to your Q1 return for the following year (January–March).

Illinois Eligibility Checklist and Credit Calculator

Contacts & Resources

Points of Contact: For questions about the application process, you can email:

CEO.JournalismTaxCredit@Illinois.gov.

Additional Support: Trade groups like the Illinois Press Foundation and Illinois Press Association have hosted informational webinars and offer assistance with application questions.

Additional Resources: More detailed FAQs can be found with the Illinois Department of Commerce & Economic Opportunity. The legislation can be found with the Illinois General Assembly.