Letter to the U.S. Department of Justice Antitrust Division on Google’s Digital Advertising Monopoly

Advocates urge DOJ to impose stronger remedies in Google ad tech case to restore competition and sustain local journalism.

Dear Assistant Attorney General for Antitrust Gail Slater:

We write as organizations advocating for the interests of journalists, news publishers, and advocates for press freedom to express our strong support for robust remedies in the Department of Justice’s case against Google’s monopolistic practices in the digital advertising market. As your team prepares for the upcoming remedies hearings, we urge you to strengthen the remedies presented to the court by highlighting the significant impact that Google’s ad tech monopoly has had on journalism and the diversity of viewpoints available to citizens for engaging in the political process.

Google’s stranglehold over the digital advertising ecosystem has undoubtedly contributed to the sustainability crisis of news media, particularly impacting smaller and local outlets that serve as the bedrock of American journalism. The importance of the digital ads market for local media cannot be overstated: From a sample of 700 digital local news outlets in the U.S. and Canada, six in 10 publishers with revenues between $10,000 and $1 million cite advertising as a “significant revenue source,” and half say it is their most significant source. Meanwhile, most news publishers, whether they’ve transitioned from print to digital or are digital-first only, find themselves with virtually no leverage in negotiations with Google’s ad tech infrastructure. The cost-prohibitive pricing structures and minimal returns generated through Google’s tightly controlled ad auction system have stripped revenue opportunities from the very news institutions our democracy depends upon to hold power to account and keep communities informed.

As the Supreme Court recently observed, the neutral application of antitrust laws is a critical tool by which the government protects the marketplace of ideas. “Of course, it is critically important to have a well-functioning sphere of expression, in which citizens have access to information from many sources. That is the whole project of the First Amendment. And the government can take varied measures, like enforcing competition laws, to protect that access.” Protection of local news necessary for an informed citizenry is “a government purpose of the highest order.” In fashioning appropriate remedies, the government must be careful not to favor one viewpoint over another. But remedies designed to promote the production of local news (as opposed to national news or international news) are viewpoint-neutral, and thus permissible. Whereas here, the illegal conduct directly contributes to the decimation of local news production, the required remedies should work to cure this harm.

When local newsrooms shutter due to the inaccessibility of advertising revenue, entire communities lose their primary source of local government coverage, investigative reporting, and civic engagement. This erosion creates information deserts that weaken democratic participation and leave citizens less equipped to make informed decisions.

The proposed remedies in this case represent a critical opportunity to restore competition in the digital advertising market in a way that supports a thriving, independent journalism ecosystem. We strongly support the proposed divestiture of AdX and the phased divestiture of DoubleClick for Publishers (DFP). We also support the additional proposals: the creation of an escrow of net revenues from AdX and DFP into a publisher transition fund, demanding data and transparency in the auction process, prohibiting self-preferential routing decisions, and barring tying of Google’s ad tech products. However, we believe the proposals can be strengthened to benefit publishers and enhance their effectiveness. To that end, we ask DOJ to place strict deadlines on the proposed phased divestiture of Google’s publisher ad server, DFP. We also encourage DOJ to pursue disgorgement of Google’s illegally gained profits as an additional equitable remedy.

Strengthening The Proposed Remedies

Reasonable and Clear Deadlines for DFP Phased Divestiture

The proposed structural remedies, particularly the divestiture of AdX and DFP, are essential steps toward rebalancing power dynamics in the digital advertising market. However, the “phased” approach to divesting DFP risks delaying the delivery of critical relief to market participants. To prevent unnecessary delays and preserve the remedy’s effectiveness, DOJ should ask the court to impose clear, enforceable deadlines for the completion of each phase of the divestiture.

Without clear, enforceable deadlines, there is a serious risk that divestiture could be delayed indefinitely. This is not a theoretical concern. In Standard Oil Co. of New Jersey v. United States, the court-ordered breakup took years to implement and left many competitive issues unresolved during that period. Specifically, the trust’s subsidiaries remained interlinked in various ways for years. Similarly, in the United States v. AT&T Co., the structural separation of the Bell System required nearly a decade to fully unfold, during which time AT&T continued to benefit from market dominance.

Google’s immediate divestiture of AdX is essential for eliminating the company’s ability to manipulate how advertising dollars flow from its buy-side tools to competing exchanges, while also ending Google’s systematic self-preference of DFP. As revealed during the trial, Google’s monopolization of the ad exchange market has enabled it to charge a 20 percent sell-side fee (paid by publishers) on transactions received by AdX to connect publishers with Google’s ad demand on AdWords. Witnesses established this was an indefensible charge serving Google to extract “irrationally high rents” from the market, effectively decreasing publishers’ share of ad revenues they would have otherwise received in a competitive market.

Removing AdX from Google’s control, combined with mandating that Google provide advertisers on AdWords with non-discriminatory access to competing ad exchanges and publisher ad servers, would provide news publishers with a level playing field to compete for open web display ad dollars for the first time in 15 years. Most notably, it would free publishers from bearing a 20 percent monopoly rent from ad prices offered by advertisers, increasing ad revenues for publishers without raising costs for advertisers.

Google’s continuous ownership of DFP would only preserve its ability to manipulate how publishers’ advertising inventory gets valued, even as Google directly competes against these publishers through its search engine (another illegal monopoly) and YouTube properties. Google has been able to strategically shift its source of ad profits; whereas in 2004, roughly half of Google’s ad revenue came from intermediating ad sales on third-party publisher websites, by 2021, only 15 percent of its ad revenue was generated through its ad tech stack (the remaining 85 percent coming from Google-owned properties.)

Even with the behavioral remedies that DOJ is proposing to have Google’s DFP connect with other ad exchanges in non-discriminatory terms, the longer Google continues to control 90 percent of the publisher ad server market, the more opportunities publishers will lose to increase their ad revenues. The trial has shown that Google’s monopoly over the publisher ad server market has unjustifiably blocked innovations that would have increased publishers’ ad revenues from being adopted more widely, such as header bidding. This has effectively killed the publisher ad server market. We therefore request DOJ design a plan, alongside its proposed divestiture trustee, containing clear milestones for each phase of the proposed divestiture to secure a full spin-off of DFP in the most effective time possible.

Disgorgement of Illegally Gained Profits

We ask DOJ to consider strengthening its remedies proposal by formally requesting disgorgement of profits earned from Google’s illegal conduct. Judicial precedent exists to support the request for this type of relief.

In Ford Motor Co. v. United States, the Supreme Court determined that equitable relief in antitrust must be directed toward eliminating the effects of the unlawful conduct and ensuring it does not continue. Years later, the Court made clear in United States v. Microsoft that antitrust remedies must both “terminate the illegal monopoly” and “deny to the defendant the fruits of its statutory violation.” Divestiture accomplishes the first; disgorgement accomplishes the second. Without disgorgement, Google retains the profits earned while its monopolies were in place, even if it no longer controls the assets that produced them.

The need for both remedies in this case is underscored by the factual record. As the Court found, Google charged durable supracompetitive prices for more than a decade, generating vast unlawful profits. These profits are directly tied to the exclusionary conduct found unlawful at trial, and they have inflicted real damage on critical adjacent markets such as online journalism and independent publishing. Removing Google’s tools of dominance (AdX and DFP) without also addressing the financial rewards of that dominance leaves the monopoly intact in economic terms. Disgorgement also plays a vital role in deterrence. Without it, emerging dominant firms in the ad tech stack may conclude that Google’s anticompetitive conduct is a profitable risk: even if caught and required to divest, dominant firms may keep the illegally obtained gains.

Use of Disgorged Profits to Benefit Publishers

DOJ’s proposal of the escrow (stemming from profits made between the date of the decision and full divestiture) to aid publishers who choose to transition out of Google’s services makes clear DOJ’s understanding that shifting away from Google’s services comes at great cost – a cost many publishers cannot afford. However, the requested 50 percent of profits to create the escrow is only from the date of the decision, a monetary amount that is minuscule in comparison to the total profits from Google’s illegal conduct over the years. Moreover, while the escrow provision is an important first step, it doesn’t account for the continued benefit from market dominance, specifically the flow of strategic data through DFP, during the transition. Google will likely retain access to valuable publisher and user-level information, which it can use to strengthen its position in owned-and-operated platforms long after divesting DFP. Disgorgement is therefore uniquely suited to serve both deterrent and restorative purposes in this case. Allocating the disgorged profits to publishers can stabilize critical adjacent markets like journalism, whose publishers were key harmed parties and witnesses in this case.

Google is deeply familiar with publishers’ woes across the globe about its outsized dominance in digital markets. Part of news publishers’ claims, such as how Google’s anticompetitive conduct siphons off ad revenues from them despite growing web traffic and news production, were ultimately key to the DOJ’s arguments in court. For over a decade, Google has strategically implemented grant programs in apparent response to regulatory pressure, first in Europe, and later with the Google News Initiative, which reportedly handed out more than $300 million by 2023 to thousands of newsrooms across the world.

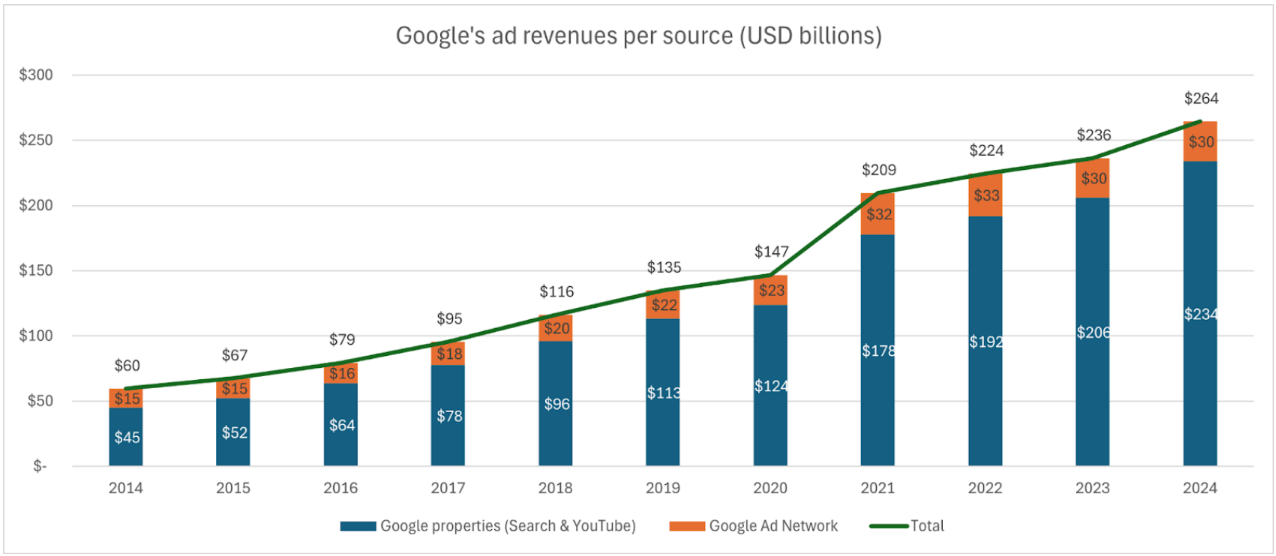

However, Google’s purported “support to journalism” falls short in light of the benefits it has gained from fortifying its advertising monopoly. Google’s revenues from its ad-tech stack in the last decade have doubled from $15 billion in 2014 to $30 billion in 2024 (see Figure 1), even as the share of such revenues has shrunk in comparison to that of Google’s owned properties (search and YouTube). These revenues all stem from fees paid by publishers and advertisers. During a similar period, from 2017 to 2024, digital ad revenues for U.S. news publishers remained flat at $5 billion.

It is fair to say that the only digital market U.S. digital news publishers are familiar with is a deeply monopolized one, both in search and the intermediation of ad sales on the open web through Google’s ad tech stack.

Considering that the unlawful tying of DFP and AdX locked in supply for Google’s buy-side tools (both DV360 and Ad Words), we urge DOJ to consider disgorgement of Google’s ill-begotten profits to be used not only within the escrow framework (with the specific goal to cover publishers’ costs of switching out of Google’s DFP and the operating costs of the new organization that would administer DFP’s auction functionality), but to be distributed through a carefully administered process (similar to a cy pres model or through court-supervised claims) that can directly support publishers that were harmed under Google’s monopoly regime. One option the court could consider would be to distribute funds according to the number of journalists employed, an approach already familiar to Google in the state of California. By doing so, DOJ can ensure some recovery of not only publishers’ switching costs but also some of their lost profits as a result of Google’s anticompetitive conduct in the ad tech industry.

Public Interest Justification

There is a substantial public interest justification for disgorging Google’s illegally gained profits to benefit news publishers. In Ford, the Court emphasized that “there is no power to turn back public interest to eliminate the effects” of unlawful conduct.

Google unlawfully maintained monopoly power in digital advertising markets for over a decade and, in doing so, earned sky-high profits from that exclusionary conduct. These profits are not only unjustly retained – they are the benefit to Google of harms caused in adjacent markets, most notably online news publishing. Judge Leonie Brinkema conceded this point in her decision, stating, “[i]n addition to depriving rivals of the ability to compete, [Google’s] exclusionary conduct substantially harmed Google’s publisher customers, the competitive process, and, ultimately, consumers of information on the open web.” Smaller and independent publishers, and primarily journalists, have suffered collateral damage from Google’s exclusionary practices. The resulting harm includes the erosion of journalism, loss of revenue for smaller publishers, and, as a result, degradation of the public’s access to a diverse digital marketplace of viewpoints and ideas. Here, given the extent of harm to free expression due to Google’s monopolistic conduct, there is a clear public interest benefit to pursuing disgorgement of Google’s profits to benefit news publishers.

Conclusion

We respectfully request DOJ amend its proposed remedies to include these recommendations. These recommendations are not only legally permissible but essential to strengthen the already strong remedies and restore healthy market competition in the online ecosystem.

Sincerely,

Public Knowledge

Center for Journalism and Liberty at the Open Markets Institute

Rebuild Local News