Policy Bulletin: How local journalists can take advantage of temporary public service loan forgiveness

Those working at nonprofit newsrooms or those who have worked for nonprofits before may be eligible to receive credit toward public service loan forgiveness via a temporarily expanded federal program.

This is different from the $10,000 or $20,000 in one-time forgiveness on federal loans. The temporarily expanded public service loan forgiveness program is a special benefit made available during the Covid-19 pandemic with an Oct. 31 deadline to employees of certain public service organizations — including nonprofit newsrooms.

Quick links:

Columbia Journalism Review article

Who should take note?

- Those who work or have worked at nonprofit newsrooms

- Those that have worked for nonprofits in the past

- Those who have worked for state or federal governments before

- Those who have participated in national service programs (Peace Corps, Americorps) or the military

Journalists should especially take note if they fall under one of the above categories AND have Perkins loans or FFEL loans. They do not typically qualify for public service loan forgiveness, but do under the temporarily widened criteria. (More on this below.)

What is it?

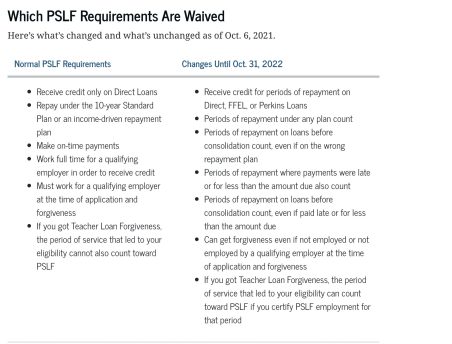

The Public Service Loan Forgiveness program is a federal program that forgives certain federal student loans after 10 years of full time employment in public service at qualifying employers, which usually include some nonprofits, national service programs and governments. All those qualifiers — certain, some, etc. — should give you an idea of how narrow this program typically is. But until Oct. 31, some of those criteria have been widened.

However, some of the criteria of the more narrow program are unchanged:

- You still have to make 120 qualifying payments (or the equivalent), which usually takes 10 years

- You still have to have been employed by a government, 501(c)(3) not-for-profit, or other not-for-profit organization that provides a qualifying service (For-profit employers are not eligible)

- You still have to have worked full time (which means you meet your employer’s definition of full time work OR 30 hours a week — whichever is greater)

- You still have to have direct loans (or have consolidated your loans into direct consolidated loans)

- You still have to certify your employment for the periods you seek credit for Public Service Loan Forgiveness

I think I qualify, how do I know for sure?

You can check your employer, or former employer here. Columbia Journalism Review also checked about a dozen well-known nonprofit newsrooms to see if they qualify. NPR, The Marshall Project and ProPublica were among those that made the list.

Does this apply to all student loans?

Not quite. Private loans are not eligible to be forgiven in either the standard Public Service Loan Forgiveness program or the temporary, widened program. However, some loans that don’t typically qualify for the program, do under the temporary criteria like Perkins Loans and FFEL Loans (a type of bundled federal loan that was administered by private loan providers – it ended in 2010 and was replaced by direct loans).

If you have either of the above loans, you will have to apply to consolidate those loans into a consolidated direct loan. (You can use the help portal to assess if you need to consolidate your loans.) You should do that as soon as possible before the deadline. Then you will need to apply for the temporarily extended public service loan forgiveness program. (You can use the federal help portal to apply, or this pdf form.)

Note: Employment prior to 2007 does not count even if it was at a qualifying employer.

What about the Covid-19 federal student loan payment pause? Does that time count even though we weren’t making payments?

If you were working full time for a qualifying employer, that time period counts even if you weren’t making payments.

Is it worth taking the time to apply if I haven’t made 120 payments yet?

If you’re in one of the employment groups above, you should absolutely look into getting credit toward public service loan forgiveness. You should especially see if you’re eligible if you are in one of the above employment groups and you have either a Perkins or FFEL loan. After Oct. 31, payments on those loans will not earn you credit toward public service loan forgiveness.

If you haven’t made 120 qualifying payments, you won’t get the remainder of your student loans forgiven right now, but it will count toward your total time. If you wait, some of your payments may not count at all.

So why is this special? Haven’t nonprofit newsrooms always qualified for the public service loan forgiveness program?

Yes, 501(c)3s have always been qualifying employers under the public service loan forgiveness program. From what we can tell, the window applies to the types of loans and payment behaviors that qualify under the window that wouldn’t usually. So if you didn’t pay in full or missed payments while working for a qualifying employer, you may get credit for those payments now, but won’t after Oct. 31. Or if you have a Perkins loan, you can now consolidate and get credit toward forgiveness.

Do you have more questions?

Feel free to email Anna Brugmann, manager of policy development at Rebuild Local News, at abrugmann@reportforamerica.org. We’d also be interested in journalists’ experiences — good or bad — taking advantage of the window. Broadening student loan forgiveness for local journalists is part of Rebuild Local News’ plan to make a better, more inclusive future for local news. Your experiences can help inform our advocacy.